道琼斯工业平均指数周五收盘突破关键的40...

Read MoreCategories

Recent Posts

- 道琼斯指数收盘创纪录高位,突破40,000点,连续五周上涨 | Ai Financial 财经日报 May 17, 2024

- AiF观点 | 要活下去,就必须在北美赚钱 May 17, 2024

- AiF观点 | 风向变了 May 17, 2024

- 华尔街接近纪录高位,迎来又一个盈利周 | Ai Financial 财经日报 May 17, 2024

- 道琼斯周四收盘下跌,首次短暂突破40,000点 | Ai Financial 财经日报 May 16, 2024

- AiF观点 | 号外!号外!道琼斯指数首次突破4万点大关! May 16, 2024

- 道琼斯指数正朝着4万点的里程碑迈进 | Ai Financial 财经日报 May 16, 2024

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- Stocks tumbled on Tuesday to close out a losing month after higher-than-expected wage data raised fresh inflation concerns ahead of the Federal Reserve’s rate decision on Wednesday.

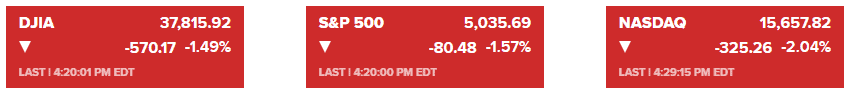

- The S&P 500 dropped 1.57% to close at 5,035.69 The Dow Jones Industrial Average fell 570.17 points, or 1.49% to finish the session at 37,815.92. The Nasdaq Composite shed 2.04% to 15,657.82.

- It was a notably ugly April for the major averages, with the Dow losing 5% for its worst monthly performance since September 2022. The S&P 500 slid about 4.2% this month, and the Nasdaq lost 4.4%. The three major averages snapped five-month winning streaks.

- The Labor Department said Tuesday the employment cost index, a measure of wages and benefits, added 1.2% in the first quarter, above the 1% consensus estimate from economists polled by Dow Jones. Treasury yields jumped following the data, with the 2-year yield topping 5%.

- The Fed will make its interest rate decision Wednesday afternoon, and officials are likely to express a reluctance to lower interest rates any time soon as inflation data continues to point to elevated price pressures.

- Despite the April setback, the S&P 500 is still up more than 20% from its low last October as investors bet the economy could withstand higher rates and piled into artificial intelligence plays like Nvidia. Data in the past month raised questions about whether stubborn inflation was weakening the economy while keeping the Fed in a restrictive mode.

- GE Healthcare Technologies tumbled 14.3% after it reported weaker results and revenue for the latest quarter than analysts expected.

- F5 dropped 9.2% despite reporting a better profit than expected. Its revenue fell short of forecasts, and it said customers were remaining cautious and forecasting largely flat IT budgets for the year.

- McDonald’s slipped 0.2% after its profit for the latest quarter came up just shy of analysts’ expectations. It was hurt by weakening sales trends at its franchised stores overseas, in part by boycotts from Muslim-majority markets over the company’s perceived support of Israel.

- Helping to keep the market’s losses in check was 3M, which rose 4.7% after reporting stronger results and revenue than forecast.

- Eli Lilly climbed 6% after turning in a better profit than expected on strong sales of its Mounjaro and Zepbound drugs for diabetes and obesity. It also raised its forecasts for revenue and profit for the full year.

- Starbucks shares sink 10% as same-store sales fall, quarterly results miss.

- Pinterest shares soar 16% on earnings beat, strong revenue growth.

U.S. STOCK PICKS

- Stocks traded into the red Tuesday after higher-than-expected wage data raised fresh inflation concerns ahead of the Federal Reserve’s rate decision on Wednesday.

- The employment cost index, a measure of wages and benefits, added 1.2% in the March quarter, above the 1% consensus estimate from economists polled by Dow Jones. Treasury yields jumped following the data.

- There’s plenty of economic news on the docket this week, with Fed policymakers convening for their two-day policy meeting on Tuesday. The central bank is broadly anticipated to keep interest rates steady, but traders worry Fed Chair Jerome Powell’s post-meeting comments will lean more hawkish after the recent spate of hotter inflation reports.

- The busiest week of corporate earnings is set to continue with Amazon and Apple reporting their quarterly results Tuesday and Thursday, respectively. The April jobs report is also expected at the end of this week, preceded Wednesday by releases on job openings and private sector employment growth.

- McDonald’s earnings miss estimates as diners pull back, Middle East boycotts hit sales.

- Musk lays off Tesla senior executives in fresh job cuts, The Information reports.

- Eli Lilly beats on quarterly profit, hikes full-year guidance on strong sales of Zepbound, Mounjaro.

- Coca-Cola tops earnings estimates, hikes revenue outlook on higher prices.

- PayPal lifts 2024 profit forecast as spending stays resilient, margins improve.

CANADA MARKET

- Canada's gross domestic product increased by 0.2% in February, less than market expectations, and the economy likely expanded at a 2.5% annualized rate in the first quarter, data showed on Tuesday.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.