自去年以来,华人社交媒体平台小红书上带有...

Read MoreCategories

Recent Posts

- 道琼斯指数收盘创纪录高位,突破40,000点,连续五周上涨 | Ai Financial 财经日报 May 17, 2024

- AiF观点 | 要活下去,就必须在北美赚钱 May 17, 2024

- AiF观点 | 风向变了 May 17, 2024

- 华尔街接近纪录高位,迎来又一个盈利周 | Ai Financial 财经日报 May 17, 2024

- 道琼斯周四收盘下跌,首次短暂突破40,000点 | Ai Financial 财经日报 May 16, 2024

- AiF观点 | 号外!号外!道琼斯指数首次突破4万点大关! May 16, 2024

- 道琼斯指数正朝着4万点的里程碑迈进 | Ai Financial 财经日报 May 16, 2024

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

Stocks break losing streak, while tech stocks rallied

Slow progress on inflation means rates will stay high for longer

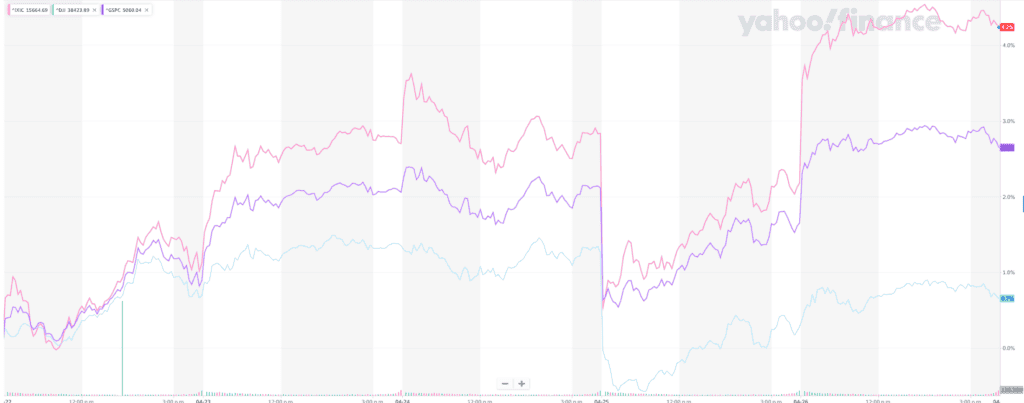

Last week, the three major U.S. stock indexes closed higher. On a weekly basis, the Dow Jones Industrial Average (DJIA) rose by 253.26 points, or 0.7%, to close at 38,239.66 points; the S&P 500 index increased by 132.73 points, or 2.7%, to close at 5,099.96 points; and the Nasdaq Composite (NASDAQ) surged by 645.89 points, or 4.2%, to close at 15,927.90 points.

Key Takeaways:

Stocks break losing streak, while tech stocks rallied

Slow progress on inflation means rates will stay high for longer

Between a barrage of earnings, the first-quarter GDP report, and the release of the Fed's preferred measure of inflation, investors had plenty to digest as markets continue to navigate a bumpy start to the second quarter.

Last week was the busiest of the earnings season, with about one-third of the S&P 500 companies reporting earnings, representing 40% of the index's market capitalization. So far results have been encouraging, with about 80% of the companies surprising to the upside and exceeding earnings expectations by 10%1. Given their outsized contribution to the index earnings, the spotlight was on the “Magnificent Seven” group of mega-cap tech names.

Profits for the Magnificent Seven are forecast to rise 47% in the first quarter from a year ago, comfortably exceeding the S&P 500’s 2% expected earnings growth2. Three of the four companies from the group that reported results last week moved higher (Tesla, Alphabet, Microsoft), with Alphabet being the standout after the company exceeded estimates and announced a dividend for the first time. But shares of Meta dipped, as the company delivered a lighter-than-expected revenue forecast while targeting higher capital spending to support AI.

AiF Insight | The Impact of 7 Major Weighted Stocks on the Market

Eyes on Fed: Last week's initial estimates of 1Q24 GDP revealed a complex picture. At the start of the year, expectations were set for gradual declines in growth and inflation. However, the data showed a sharp deceleration in headline growth while inflation, as measured by the personal consumption expenditures price index (PCE), accelerated on a quarter-to-quarter basis. This has raised concerns about potential stagflation and its implications on interest rates and markets.

Looking at the details, first-quarter real GDP grew at an annualized rate of 1.6%, roughly half the pace of the previous quarter and below the Fed’s forecasts for 2024 and the longer term. However, volatile components like trade and inventories, which often swing up and down in consecutive quarters, significantly impacted this slowdown. As the chart of the week highlights, excluding those components, the economy grew at a healthy 3.1% rate — slightly above last year's average. This growth was supported by a strong labor market, evident from fewer jobless claims, which in turn bolstered consumer spending — rising by 2.5%, nearly aligning with its 20-year trend. This suggests that concerns over economic stagnation may be exaggerated, as the headline figure masked the underlying strength.

The Fed's preferred measure of inflation, the core personal consumption expenditures price index (PCE), was the last key datapoint on prices to be released for the month of March, and it confirmed the message delivered by the consumer price index (CPI) a couple of weeks ago. Progress toward the Fed's 2% target stalled in the first quarter, which, together with a resilient economy, means that policymakers have every reason to be patient with rate cuts.

Core PCE, which strips out the volatile food and energy components, increased 0.3% from the prior month and 2.8% from a year ago, holding steady from February. While elevated, it is still one percentage point lower than the core CPI because of the lower weight in housing (18% share in core PCE vs. the 43% share in CPI). Despite the rapid pace of price increases in March, it hasn't instilled confidence in the Federal Reserve. While recent reports still indicate a decline in inflation, it has turned into a very slow decline, tempering market expectations for rate cuts this year.

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.

Newsletter Subscription

Calendar:

- April 30: April Consumer Confidence, Q1 Employment Cost Index, and expected earnings from 3M (MMM), Coca-Cola (KO), Eli Lilly (LLY), McDonald's (MCD), Advanced Micro Devices (AMD), Amazon (AMZN), Starbucks (SBUX), and Super Micro Computer (SMCI).

- May 1: FOMC meeting announcement and press conference, March construction spending, April ISM Manufacturing Index, and expected earnings from CVS Health (CVS), DuPont (DD), Estee Lauder (EL), Mastercard (MA), and Carvana (CVNA).

- May 2: March Trade Balance, March Factory Orders, and expected earnings from Baxter (BAX), ConocoPhillips (COP), Apple (AAPL), Amgen (AMGN), and Coinbase (COIN).

- May 3: April Nonfarm Payrolls, April ISM Non-Manufacturing PMI, and expected earnings from Hershey Foods (HSY).

- May 6: Expected earnings from Palantir (PLTR) and CNA Financial (CNA).

The US stock market is in a bull market. Ai Financial, with its professional investment philosophy, seizing the opportunities of our time together and reap wealth.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Ai Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.