自去年以来,华人社交媒体平台小红书上带有...

Read MoreCategories

Recent Posts

- 道琼斯指数收盘创纪录高位,突破40,000点,连续五周上涨 | Ai Financial 财经日报 May 17, 2024

- AiF观点 | 要活下去,就必须在北美赚钱 May 17, 2024

- AiF观点 | 风向变了 May 17, 2024

- 华尔街接近纪录高位,迎来又一个盈利周 | Ai Financial 财经日报 May 17, 2024

- 道琼斯周四收盘下跌,首次短暂突破40,000点 | Ai Financial 财经日报 May 16, 2024

- AiF观点 | 号外!号外!道琼斯指数首次突破4万点大关! May 16, 2024

- 道琼斯指数正朝着4万点的里程碑迈进 | Ai Financial 财经日报 May 16, 2024

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

Global dynamics, rate expectations, and earnings impact market volatility;

Bull market persists, pullback brings investment opportunities

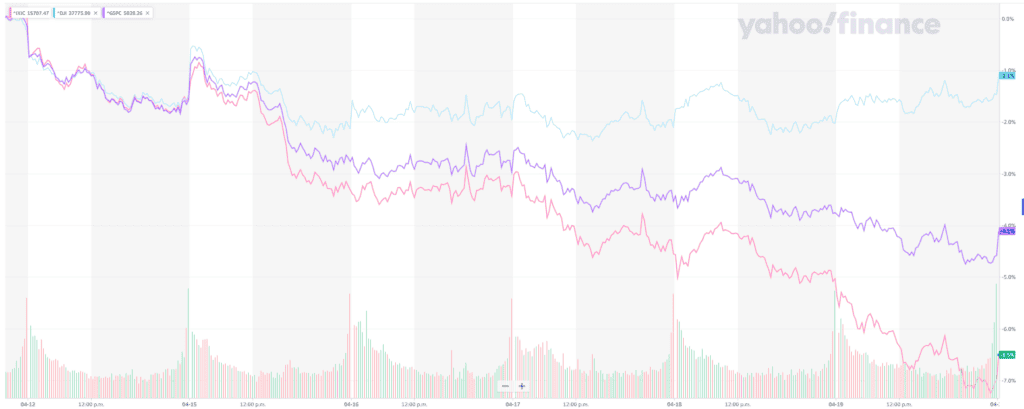

Last week, the three major US stock indexes closed with mixed movements. From a weekly perspective, the Dow Jones Industrial Average (DJIA) edged up by 3.16 points, or 0.01%, to close at 37,986.40 points; the S&P 500 index fell by 156.18 points, or 3.0%, to close at 4,967.23 points; and the Nasdaq Composite (NASDAQ) dropped by 893.08 points, or 5.5%, to close at 15,282.01 points.

Key Takeaways:

Global dynamics, rate expectations, and earnings impact market volatility;

Bull market persists, pullback brings investment opportunities

After a strong rally in the stock market, markets have started to soften in recent weeks. We know that market corrections are normal in any given year, especially after the S&P 500 index rose by 25% over the past six months. The S&P 500 has closed lower for the third consecutive week, while the tech-heavy Nasdaq has been down for the fourth consecutive week. So far, the magnitude of the market pullback has been relatively small: the S&P 500 index has fallen by about 5.5% from recent highs, while the Nasdaq index has fallen by about 7%. However, parts of the market that are sensitive to interest rates, including small-cap stocks and the real estate industry, have experienced larger declines. Additionally, the VIX volatility index, sometimes referred to as the "fear index," has approached highs for the year.

The recent volatility in the market has been sparked by a triple impact of recent data and news:

- First, the market has reassessed expectations for Fed rate cuts, now expecting only one rate cut in 2024, or even none at all. The market is adjusting to this new "higher for longer" interest rate environment.

- Second, geopolitical tensions are rising, especially in the Middle East, which has put upward pressure on oil and commodity prices in recent weeks.

- Third, the first-quarter earnings season for the S&P 500 is underway. Although companies have exceeded expectations in terms of earnings, their outlooks have been weaker than expected. Major tech companies, including Microsoft, Google, and Meta, will report earnings this week, and investors will closely watch for any signs of weakness.

Consumers continue shopping, but housing market shows signs of stress:

- Some strong economic data appeared to increase worries that the Federal Reserve would push back any interest rates cuts to the fall, if not to 2025. On Monday, the Commerce Department reported that retail sales rose 0.7% in March, well above consensus expectations of around 0.3%, while February’s gain was revised upward to 0.9%. Rising gas prices were partly at work (the data are not adjusted for inflation), but the strength was broad-based and included healthy gains in discretionary categories, such as restaurants and bars and online retailers.

- Conversely, downward surprises in housing market data may have furthered inflation fears by auguring continued supply tightness. Housing starts and permits in March came in well below expectations and declined from February, with the former falling to the lowest level in seven months. Existing home sales also declined, although largely in line with expectations, as the average 30-year mortgage rate climbed above 7% for the first time since December.

Market volatility after a strong rally is not unexpected. Although it's difficult to predict the bottom of a pullback, we know that corrections in the range of 5% to 15% occur every year. Some investors are concerned that the market pullback could evolve into a deep or prolonged bear market environment (typically with losses of 20% or higher). We see this as unlikely, especially considering that the U.S. economy remains fairly strong, supported by robust consumer demand and a healthy labor market, and global economic growth is also stabilizing. Therefore, investors can use this pullback to rebalance, diversify, and use dollar-cost averaging, especially those who have not fully participated in the recent rapid rise.

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.

Newsletter Subscription

Opening Market Update:

Wall Street enters the heart of earnings season reeling from fierce selling that sent the broader market to two-month lows late last week, chopping the 2024 rally in half. Tech and other growth sectors suffered most amid rising Treasury yields, geopolitical fireworks, and mixed earnings news, but there are signs of oversold conditions.

For bullish investors, it's likely a letdown to see the S&P 500® index (SPX) dip back below 5,000 or witness the Dow Jones Industrial Average® ($DJI) approach 40,000 and then retreat so dramatically. Both the SPX and the Nasdaq-100® (NDX) are on six-session losing streaks, and last week was the worst in more than a year for the SPX as formerly high-flying semiconductor shares fell back to Earth.

Keep in mind, though, that it's normal for the market to spend weeks or even months consolidating gains. The 5% drop from all-time highs could represent a healthy pause for Wall Street, which hadn't experienced a major pullback since last October. The 25% rally from then to late March took major indexes to historically high valuation levels above 20 on a price-to-earnings (P/E) basis for the SPX, which history suggests are tough to maintain as interest rates stay higher for longer.

Strong earnings, if they arrive, could help from a valuation standpoint. Earnings take center stage starting with Tesla (TSLA) tomorrow, followed by Microsoft (MSFT), Meta Platforms (META), and Alphabet (GOOGL) later this week. Overall, about one-third of S&P 500 companies report this week.

Another helpful factor might be any sign of inflation progress, and the March Personal Consumption Expenditures (PCE) prices report, the Federal Reserve's favored inflation metric, is due Friday.

The US stock market is in a bull market. Ai Financial, with its professional investment philosophy, seizing the opportunities of our time together and reap wealth.

21.6%

Average Annual Compound Return For Past 10 Years

Ai Financial delivers consistent and stable investment returns to clients, achieving 10%+ annual compounded returns over the past decade.

Thursday Seminar

Free Financial Online Seminar

Weekly free online seminars every Thursday evening, offering investors the latest insights on hot topics and market trends.

Mission and Vision

You fulfil your dream, we pay for your bill

Improve Canadian Retirement System.

Ai Financial Funds Investing - You fulfill your dreams, we cover your bills

Ai Financial is a leading Canadian Fin-Techfund investmentservice provider. We leverage cutting-edge technology to adhere toValue Investing principles,aiming to drive reform in Canada's pension system and enable more people to live better lives through financial investment.

Ai Financial has a background in financial compliance and anti-money laundering (AML). Through collaborations with banks, funds, and insurance companies, we select fund products suitable for clients and managevarious investment accountssuch as TFSA and RRSP. Additionally, we assist clients in applying for unique CanadianInvestment Loan, facilitating early attainment of financial freedom.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.